-

Business & ToolsDrop Catching Domain Names & Backorders Detagged or Suspended UK Domain Names Drop Lists

Domain Tools & Research Domain Tools Domain Research WHOIS ? Domain Traffic / Keyword Research

Domain Parking & Monetization Platforms DomainUi

Domain Disputes, Fraud & Legal (UDRP/DRS) Domain Name Registrars & Marketplaces

Membership is FREE – with unlimited access to all features, tools, and discussions. Premium accounts get benefits like banner ads and newsletter exposure. ✅ Signature links are now free for all. 🚫 No AI-generated (LLM) posts allowed. Share your own thoughts and experience — accounts may be terminated for violations.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stocks

- Thread starter Murray

- Start date

Murray

Nominet Registrar

- Joined

- Sep 3, 2012

- Posts

- 4,196

- Reaction score

- 1,000

@Murray Are you going to start betting against the market?

Currently no

I'm willing to bet on the dollar which I think will move in opposite to the market though, at least in the short term

I talked a bit about it in the bitcoin thread but my thinking is based on dollar liquidity

The monetary system is a debt based one, ever increasing new debt has to be created to feed the old debt + create more dollars for circulation

New dollars are created from banks lending and they've been tightening their loan standards

The past few months there have been deferrals on mortgages and loans, so currency wasn't being fed into the wood chipper so it didn't matter so much there wasn't new debt being created + there was stimulus from the government to increase consumer spending

Now deferrals have begun to end, now there isn't stimulus checks + with banks still not lending and consumer spending going down.. it's going to go very bad, dollars are going to be required to pay back debts and they will be sucked out of equities, commodities, crypto etc and bonds will become the safe haven and the dollar will rally strongly due to demand and deflation

I don't think I need to bet on the way down, I think I will make enough money from buying precious metals (gold miners and silver etf etc) and bitcoin cheaply and them flourish for the next several years

That's the grand theory of how it will all play out anyway, whether it does or not who knows

In the meantime I have a decent amount of money in GGP and that's gone very well, I've taken profit, if it were to now crash along with everything else it would only be a small loss vs what I originally put in, if it continues to flourish great

- Joined

- May 28, 2009

- Posts

- 1,294

- Reaction score

- 153

@davedevelopment I was thinking about this today and thought it's good advice for anyone thinking of investing in stocks or trading...

Appreciate the concern, but I've a wise old head on me now, slow and steady all the way. I'll be sticking with demo accounts while I learn.

Also won't be doing any real trading until I've laid the laws down with the wife. She'll probably not be interested in anything I say and I'll just be told "don't fuck up", but it makes me feel better if I make everything transparent.

- Joined

- Nov 20, 2013

- Posts

- 2,439

- Reaction score

- 197

Appreciate the concern, but I've a wise old head on me now, slow and steady all the way. I'll be sticking with demo accounts while I learn.

Also won't be doing any real trading until I've laid the laws down with the wife. She'll probably not be interested in anything I say and I'll just be told "don't fuck up", but it makes me feel better if I make everything transparent.

Hi Dave, you are right its a marathon not a sprint, Trading is like learning to ride a bike, it will take a bit of time for things to fall in place. Some will learn it quicker than the other and its best ti give yourself enough time.

To support the idea of talking to the wife, you are right there. I trade with my wife, infact we all trade in our house and my wife is the one that always peg my ego when I start tripping.

I learn it first, taught the older son, my younger one is 15, his one year old account he started with £500 is now 6k plus. He started with hourly chart but change to daily chart because of school and during school breaks so he can spend more time on Xbox. Daily chart is good, it gives you a lot of time to do other things and no need to rush into trades.

I will say learn to trade first before investing and I will recommend Forex, it's the largest market and you don't need to worry about fundamentals too much. I don't trade the news but I keep eye on them and use them to manage my trade sizes.

Stock is good because there is a lot to chose from but you will need to learn a lot more than technical and fundamentals will play a lot here. This is what Murray explains above.

All you need is one good strategy, loads of patience and discipline. Patience and discipline are the key really, without these two no strategy will work.

If you need some tips on how to start let me know.

- Joined

- Nov 20, 2013

- Posts

- 2,439

- Reaction score

- 197

@Murray Are you going to start betting against the market?

Hi Ian,

You cant bet against the market, market is always right even when you think it does not make sense, Market is still right.

Murray

Nominet Registrar

- Joined

- Sep 3, 2012

- Posts

- 4,196

- Reaction score

- 1,000

I was just listening to a Real Vision video and Raoul Pal said something that perked my interest that I don't know a lot about

"I had this discussion with people in gold before the correction, it's getting pretty frothy, I'm still a gold bull but these things can go up and down, why not own calls instead of stock? because then you're locking in your profits, all you can lose is the premium in your calls and you're still participating in the upside and you can look like a hero"

His guest then said he was told my Charlie Munger

"If profit in your stock most people sell winners far too early, if you have to do one thing, say you're up $x amount, sell your stock you're up on and use 25-30% of the profit and buy a long term call spread and be there for the big one"

Does anyone have a practical example of how this would work?

It seems like buying with leverage and your long/short call are like take profits and stop loss

But I don't understand how the leveraged is figured out? because you're buying contracts or something.. does it just depend on how many you buy or do you set the leverage on the contracts, it's confusing

"I had this discussion with people in gold before the correction, it's getting pretty frothy, I'm still a gold bull but these things can go up and down, why not own calls instead of stock? because then you're locking in your profits, all you can lose is the premium in your calls and you're still participating in the upside and you can look like a hero"

His guest then said he was told my Charlie Munger

"If profit in your stock most people sell winners far too early, if you have to do one thing, say you're up $x amount, sell your stock you're up on and use 25-30% of the profit and buy a long term call spread and be there for the big one"

Does anyone have a practical example of how this would work?

It seems like buying with leverage and your long/short call are like take profits and stop loss

But I don't understand how the leveraged is figured out? because you're buying contracts or something.. does it just depend on how many you buy or do you set the leverage on the contracts, it's confusing

- Joined

- Dec 22, 2009

- Posts

- 3,093

- Reaction score

- 245

Good call! My shares have also gone up... not sure whether to let them ride or not. They're within a Lifetime ISA that i'd put 8k total into (just before and after tax year). GVC is up 31%, William Hill 114%. With the government bonus factored in and invested at the same time my 8k is now 15k+. I consider myself fortunate to have got involved when I did!

I've been fortunate again. I got out of my Vanguard index funds on account that the stock market seas have felt rather choppy of late! I left my Lifetime ISA shares in William Hill and GVC though, as they've been performing well over the months. Last week William Hill received a boost when they were chosen to become ESPN's exclusive daily fantasy sports provider and sportsbook provider in the states. And today shares were up 43% on news of buyout offers from Caesars and Apollo . GVC now up 50% since I bought, and William Hill 240%!

Last edited:

- Joined

- Dec 22, 2009

- Posts

- 3,093

- Reaction score

- 245

So I started trading in Forex a week last Monday under my sons guidance.

The investment started £1,000

The value of the pot as of today is £2,219

Very happy with the result.

That great news. Congratulations on your initial success. Long may they continue! Nice that it's a family affair too

That great news. Congratulations on your initial success. Long may they continue! Nice that it's a family affair too

I lost 23 trades from £1.32 to £22.80

I won 55 trades from £0.66 to £145.41

So it looks to have worked these last 2 weeks, would have to give it a year to see how it pans out!

- Joined

- May 8, 2013

- Posts

- 2,515

- Reaction score

- 859

nice one. Dont suddenly think your invincible though and start thinking " oh ill just change the stop loss as its gonna come back " Thats what normally happens and before you know it your down 50% .

You trading technicals or fundamentals ? Always interested in a good setup.

You trading technicals or fundamentals ? Always interested in a good setup.

Murray

Nominet Registrar

- Joined

- Sep 3, 2012

- Posts

- 4,196

- Reaction score

- 1,000

I lost 23 trades from £1.32 to £22.80

I won 55 trades from £0.66 to £145.41

So it looks to have worked these last 2 weeks, would have to give it a year to see how it pans out!

is 78 trades over two weeks a typical amount? seems very active

What was the average time you held a position? and what time frame are you trading on if you don't me asking

Thanks

nice one. Dont suddenly think your invincible though and start thinking " oh ill just change the stop loss as its gonna come back " Thats what normally happens and before you know it your down 50% .

You trading technicals or fundamentals ? Always interested in a good setup.

Neither really, my son messages me buy/sell including lot size and pip size for stop loss.

He'll message me to get out of a trade.

He measures the news, Brexit, trump, China, Australia, Unemployment, vaccine news, virus financial strategies, any other calamities.

He uses a currency strength tool, and an app to calculate lot size needed for the 2% trade.

I also try myself and have a go using gut instinct, low risk amount only.

From minutes, to about 30 mins i guess.is 78 trades over two weeks a typical amount? seems very active

What was the average time you held a position? and what time frame are you trading on if you don't me asking

Thanks

My own trades can be a couple of hours until i make a profit.

- Joined

- May 8, 2013

- Posts

- 2,515

- Reaction score

- 859

He should set up a whatsapp group and charge 10% of client profits. I'd be interested.

this

- Joined

- May 8, 2013

- Posts

- 2,515

- Reaction score

- 859

and Raoul Pal said something that perked my interest that I don't know a lot about

- Joined

- May 28, 2009

- Posts

- 1,294

- Reaction score

- 153

So I started trading in Forex a week last Monday under my sons guidance.

The investment started £1,000

The value of the pot as of today is £2,219

Very happy with the result.

That's impressive!

So far my adventures have seen me lose about £800 of hypothetical funds on FXCM, but happy to be learning. That's mostly trying to trade on price action. I think around £500 of the loss came in one trade though, when I inadvertently miscalculated the pips and put myself in for 10x the volume I meant to. Lesson learnt there!

Murray

Nominet Registrar

- Joined

- Sep 3, 2012

- Posts

- 4,196

- Reaction score

- 1,000

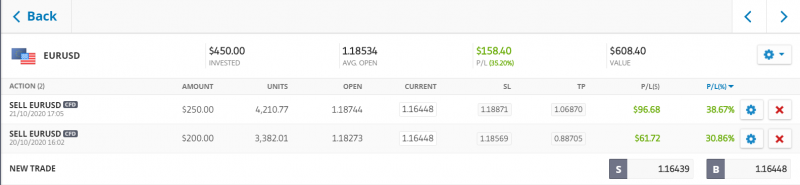

The dollar seems to have bottomed out with EU stimulus more likely to come before US

With that in mind I opened a couple small positions, I haven't got my head around how to use any new fx dedicated platforms yet so I'm still using Etoro for now

I'm hoping to hold these open for a while, several months if possible all going well and make a few hundred dollars but if the US election doesn't go smoothly that could turn $160 up into stopped loss out very quickly

Trading is a weird one, being up a small amount I'm quite blazae about but if I was down $160 i'd feel sick

With that in mind I opened a couple small positions, I haven't got my head around how to use any new fx dedicated platforms yet so I'm still using Etoro for now

I'm hoping to hold these open for a while, several months if possible all going well and make a few hundred dollars but if the US election doesn't go smoothly that could turn $160 up into stopped loss out very quickly

Trading is a weird one, being up a small amount I'm quite blazae about but if I was down $160 i'd feel sick

My random stab Not financial advice.

Not financial advice.

Stocks are irrelevant of value of companies as they are now mostly being propped up by governments...ie if US gov does not support airlines then they go bust, hence many share prices now are based on people thinking which gov will support them.

As world interest rates go to zero, all that money is hunting for value and hence asset prices have gone way passed historic averages. Example Apple turnover and profits have hardly moved in the past year but share price has almost doubled. Money is hunting for safety and will also accept low returns.

Add to that mix over 70% on international trade is done in US$'s and as people head for safety they mostly have to trade in $'s and hence demand for $'s increases. Fed then prints trillions of $'s to pump into the US economy and also allow the world to trade easier...otherwise global trade stops as many people are simply holding US bonds and hence no $'s available to allow trade to happen. Chinese gov is pushing to do trade deals in Chinese currency and hence trying to diminish the $ as the global currency of trade....if this happens then people will dump the $ and hence anything priced in $'s will collapse.

Thus my view/opinion/guess is that as world goes into more madness the wealth of the world will head for safety.....$'s, gold, winner take all stock ( Faang's etc ), quality stock where company prints cash or holds solid assets...if you want the extreme side Bitcoin ( as many people see this as a virtual gold )...price has gone from $4K to $13K in past 6 months.

Just my random thoughts on a Friday evening.

Stocks are irrelevant of value of companies as they are now mostly being propped up by governments...ie if US gov does not support airlines then they go bust, hence many share prices now are based on people thinking which gov will support them.

As world interest rates go to zero, all that money is hunting for value and hence asset prices have gone way passed historic averages. Example Apple turnover and profits have hardly moved in the past year but share price has almost doubled. Money is hunting for safety and will also accept low returns.

Add to that mix over 70% on international trade is done in US$'s and as people head for safety they mostly have to trade in $'s and hence demand for $'s increases. Fed then prints trillions of $'s to pump into the US economy and also allow the world to trade easier...otherwise global trade stops as many people are simply holding US bonds and hence no $'s available to allow trade to happen. Chinese gov is pushing to do trade deals in Chinese currency and hence trying to diminish the $ as the global currency of trade....if this happens then people will dump the $ and hence anything priced in $'s will collapse.

Thus my view/opinion/guess is that as world goes into more madness the wealth of the world will head for safety.....$'s, gold, winner take all stock ( Faang's etc ), quality stock where company prints cash or holds solid assets...if you want the extreme side Bitcoin ( as many people see this as a virtual gold )...price has gone from $4K to $13K in past 6 months.

Just my random thoughts on a Friday evening.

Similar threads

- Replies

- 0

- Views

- 405

- Replies

- 0

- Views

- 293

- Replies

- 0

- Views

- 231

- Replies

- 0

- Views

- 728